Many Alabama homeowners believe their insurance policy protects them from all potential risks. That belief can lead to some nasty surprises when disaster actually hits.

Standard homeowner insurance policies in Alabama often contain numerous coverage gaps that can leave families financially vulnerable during their most critical times of need.

From flood damage to sewer backups, these coverage gaps affect thousands of Alabama residents each year.

The state’s climate and location present challenges that many basic insurance policies do not adequately address.

Alabama faces hurricanes, tornadoes, flooding, and severe storms that can cause damage far exceeding what typical policies cover.

Understanding these gaps before you ever file a claim can spare you from some truly painful out-of-pocket expenses.

Common coverage gaps in homeowners’ insurance often catch people off guard when they need protection most.

Identifying these weak spots early and addressing them with extra coverage or endorsements makes a significant difference.

Key Takeaways

- Standard Alabama homeowner policies contain significant coverage gaps that can leave families financially exposed during disasters.

- The state’s unique weather risks require specialized coverage that basic policies typically don’t include.

- Reviewing and addressing coverage gaps before renewal can prevent costly claim denials and out-of-pocket expenses.

Why Standard Homeowner Insurance In Alabama Often Falls Short

Standard homeowners’ insurance policies in Alabama often leave property owners vulnerable to significant financial losses due to common exclusions.

These gaps in coverage tend to catch people off guard, especially given Alabama’s frequent natural disasters and extreme weather conditions.

Overview Of What A Typical “Standard” Policy Covers

A standard homeowners insurance policy in Alabama provides basic protection for the risks most homeowners face. Dwelling coverage protects the physical structure of your home against covered perils like fire, lightning, windstorms, and hail.

Personal property coverage protects your stuff inside the house—furniture, electronics, clothing, and other belongings—if a covered event damages them.

Liability protection covers you if someone gets hurt on your property. It can also help if you accidentally cause damage to someone else’s property.

Additional living expenses help cover temporary housing if your home becomes uninhabitable after a covered loss and needs repairs.

Most policies include medical payments coverage for minor injuries to guests, no matter who’s at fault.

The Most Common Exclusions (Flood, Earthquake, Mold, Sewer Backup)

Homeowners insurance policies leave out several major risks that Alabama residents deal with all the time:

Flood damage tops the list. Water from hurricanes, heavy rains, or overflowing rivers—pretty common in Alabama—doesn’t get covered.

Earthquake damage doesn’t get covered under standard policies. Although earthquakes are relatively rare here, they can still cause significant damage.

Mold growth is out unless it comes directly from a covered peril. Alabama’s humidity makes mold a headache for many homeowners.

Sewer backup and drain overflow damage aren’t included. Heavy rains can overwhelm city systems, sending sewage directly into your home.

Wear and tear from regular use is never covered. That means you’re left with gradual roof leaks, old HVAC systems breaking down, and other aging issues.

Pest problems, including termite damage, are excluded, too. Alabama’s warm climate means that termites pose a significant threat.

How These Exclusions Cause Financial Surprises

These coverage gaps create some serious financial risks for Alabama homeowners. Location is the most significant factor influencing home insurance rates in Alabama; however, standard policies often overlook location-specific risks.

Flood damage is the priciest shocker. Just one flood can rack up tens of thousands in damages to your floors, walls, and belongings.

Mold remediation can easily run from $500 to $6,000 per incident. If mold spreads deep or wide, costs can soar past $30,000 for full removal and repairs.

Sewer backups typically cost between $3,000 and $5,000 for cleanup and repairs. The contaminated water necessitates the involvement of professionals and poses significant health risks.

Liability coverage gaps can leave you exposed. Standard policies often don’t provide sufficient protection for high-net-worth homeowners facing substantial lawsuits resulting from injuries on their property.

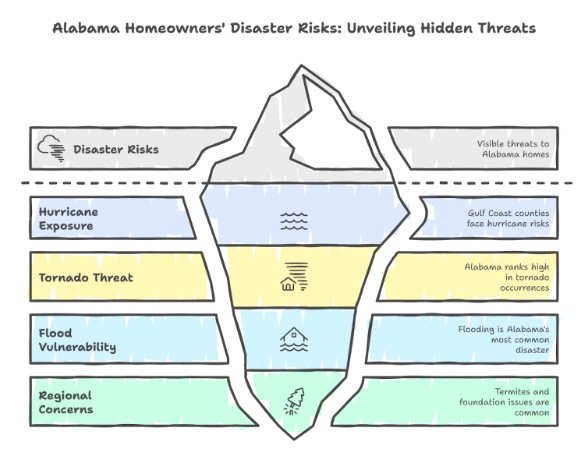

Alabama-Specific Risks Homeowners Need To Know

Alabama homeowners face unique disaster risks that standard insurance may not fully cover.

The state’s location puts it in the path of hurricanes, tornadoes, flooding, and even regional headaches like termites.

Hurricanes And Tropical Storms (Gulf Coast Exposure)

Alabama’s Gulf Coast counties are frequently hit by hurricanes from June through November. Mobile and Baldwin counties take most of the hits, but storms can reach 100 miles inland.

Hurricane damage often exceeds the coverage limits of basic homeowners’ policies. Wind gets covered, but storm surge flooding? That’s a separate flood insurance policy. A lot of people only find out after the fact.

Key hurricane risks include:

- Storm surge flooding along the coast

- High winds over 75 mph

- Heavy rainfall is causing inland flooding

- Power outages that can last for weeks

The 2004 and 2005 hurricane seasons cost Alabama billions. Hurricane Ivan alone led to more than $1 billion in losses statewide.

Standard policies often have separate wind and hail deductibles, ranging from 1% to 5% of your home’s value. That can mean unexpected out-of-pocket costs when you file a claim.

Tornado And Windstorm Risk Across The State

Alabama ranks fourth in the country for tornadoes. The state averages 44 tornadoes a year, mostly from March through May.

Northern Alabama is smack in “Dixie Alley,” where some of the nation’s strongest tornadoes touch down. The April 2011 outbreak brought 62 tornadoes in one day and killed 238 people statewide.

High-risk tornado counties include:

- Jefferson

- Madison

- Marshall

- DeKalb

- Cullman

Most policies cover tornado damage under wind coverage, but watch for those separate wind deductibles. Some insurers won’t cover detached structures unless you buy extra endorsements.

Straight-line winds from severe storms can do major damage, too. These events occur more frequently than tornadoes, but most people don’t give them much thought.

Flooding (Inland And Coastal)

Flooding is Alabama’s most common natural disaster. Standard homeowners’ insurance doesn’t cover flood damage, leaving a major coverage gap for most homeowners.

Coastal flooding from storm surges hits Gulf Coast areas, while inland flooding comes from heavy rain, river overflow, or flash floods in cities.

Major flood zones include:

- Mobile River basin

- Tennessee River valley

- Coosa River system

- Urban areas like Birmingham and Montgomery

Alabama homeowners may consider purchasing supplemental coverage, such as flood insurance, for properties located in flood-prone areas. National Flood Insurance Program policies require a 30-day waiting period before coverage takes effect.

Flash floods are a big risk in Alabama’s hilly areas. Even places outside official flood zones can get hit during extreme storms.

Regional Concerns Like Termites And Foundation Issues

Alabama’s humid subtropical climate is perfect for termites and moisture-related foundation problems. Standard homeowners’ policies rarely cover these headaches.

Subterranean termites cause millions in property damage every year. The warm, wet climate means termites stay active year-round in southern counties.

Common regional issues include:

- Termite infestations in wooden houses

- Foundation settling from shifting clay soil

- Mold from high humidity

- Moisture damage in crawl spaces

Clay soils in central Alabama expand and contract in response to changes in moisture. This can compromise your foundation and cause damage to your house over time.

Most insurers do not cover damage caused by insects, rodents, or earth movement. Foundation problems from settling usually fall under the excluded earth movement rules.

Some insurers offer endorsements for specific regional risks, but these come at an additional cost and may be accompanied by strict rules or waiting periods.

If you’re ready to get started, call us now!

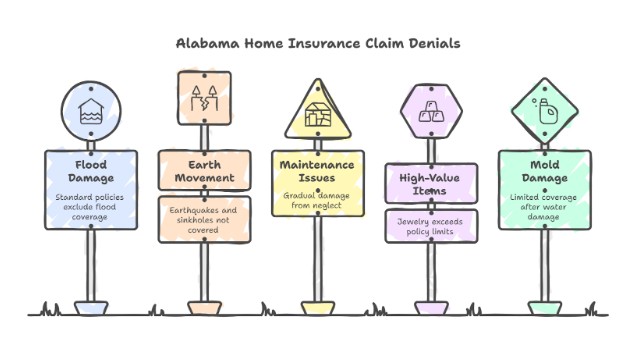

Common Coverage Gaps That Lead To Denied Claims

Many Alabama homeowners receive claim denials due to coverage exclusions they were unaware of. Understanding these gaps can help you dodge those expensive surprises when something goes wrong.

Home insurance companies deny about 5-10% of all claims nationwide. Alabama homeowners see even higher denial rates during rough weather seasons.

Common reasons for denial include:

- Flood damage – Standard policies exclude flood coverage

- Earth movement – Earthquakes and sinkholes need separate policies

- Maintenance issues – Gradual damage from neglect

- High-value items – Jewelry and electronics often go over policy limits

Insufficient coverage is the top reason for claim rejections. A lot of Alabama policies use market value instead of replacement cost, which can leave you short.

Property damage from excluded perils can cost homeowners thousands out of pocket. The average denied claim results in damages ranging from $15,000 to $25,000.

An infographic could lay out Alabama’s most common coverage gaps with clear icons and percentages:

| Risk | Coverage Gap | Average Cost |

| Flooding | 95% of policies exclude | $30,000+ |

| Mold damage | Limited coverage after water damage | $10,000-$15,000 |

| Sewer backup | Not covered without endorsement | $5,000-$8,000 |

| Home business | Personal property only | $3,000-$12,000 |

| High-value items | Standard limits apply | $2,000-$20,000 |

The visual should make it clear that most policies don’t cover everything homeowners expect them to.

Unsure if you’re covered for Alabama’s biggest risks? Contact Woodall & Hoggle now to schedule your complimentary homeowner insurance audit.

Cost Comparison — Standard Vs. Comprehensive Coverage In Alabama

Alabama homeowners notice a significant price difference between basic and comprehensive policies. Homeowners insurance costs run from $1,300 to $2,500 a year for standard coverage, depending on where you live.

The state’s high disaster risk really makes understanding coverage differences more important than ever.

Average Premium Cost Of A Basic Policy Vs. Extended Coverage

Basic homeowner policies in Alabama usually cost between $1,300 and $1,700 per year. These cover standard perils—fire, theft, wind damage, and the like.

Comprehensive coverage with extra endorsements bumps the price to $2,500 to $4,200 annually. The average Alabama homeowner pays $4,123 per year, which is $1,700 more than the national average.

Standard Policy Coverage:

- Dwelling protection

- Basic personal property coverage (50-70% of dwelling amount)

- Limited additional living expenses

- Standard liability protection

Comprehensive Policy Additions:

- Enhanced personal property coverage (up to 100% of dwelling value)

- Extended additional living expenses coverage

- Flood insurance endorsements

- Earthquake protection

- Higher liability limits

The price difference primarily stems from Alabama’s high risk of severe weather. Tornado-prone areas end up with the highest premiums for comprehensive coverage.

Long-Term Financial Risk Of Uncovered Claims Vs. Added Cost Of Endorsements

Standard policies leave homeowners with a significant financial gap. Flood damage, which affects many Alabama homes, requires separate coverage—typically $400 to $1,200 per year extra.

Personal property coverage in basic policies only covers 50% of the dwelling value. So, if you have a $200,000 home, you get just $100,000 for your belongings.

Common Coverage Gaps:

- Flood damage (needs a separate policy)

- Earthquake damage

- Sewer backup

- Identity theft protection

Standard policies usually cap additional living expenses at 20% of dwelling coverage. That means $40,000 for a $200,000 home—sometimes not enough for long hotel stays during big repairs.

Enhanced endorsements cost between $200 and $800 per year. But they can save you from $20,000 to $100,000 in out-of-pocket expenses. In Alabama’s high-risk weather, comprehensive coverage just makes sense.

Why “Cheap Policies” Often Cost More After A Disaster

Budget policies appear effective until you actually need them. Alabama’s location and severe weather risks make comprehensive coverage a necessity if you want real financial protection.

Low-cost policies usually feature:

- High deductibles ($2,500 to $5,000)

- Limited personal property coverage (actual cash value, not replacement cost)

- Restricted additional living expenses (short time limits)

- Minimal liability protection ($100,000 or less)

After a tornado or severe storm, homeowners quickly discover these limitations. Personal property coverage pays you for the depreciated value of items, not the cost of replacing them.

Additional living expenses typically run out in a few months, so families often end up paying their own hotel and restaurant bills.

A six-month displacement in one of Alabama’s larger cities can easily cost between $15,000 and $25,000.

The $500 to $1,000 annual savings from cheap policies quickly disappear when disaster strikes. Comprehensive coverage helps you avoid those nasty surprises.

If you’re ready to get started, call us now!

How Woodall & Hoggle Helps Alabama Homeowners Protect Themselves

Woodall & Hoggle Insurance helps Alabama homeowners by combining decades of experience with thorough coverage reviews and local knowledge of state-specific risks.

Their personalized approach ensures clients receive comprehensive protection tailored to Alabama’s unique insurance needs.

150+ Years Combined Experience In Identifying Risks

The folks at Woodall & Hoggle have seen it all when it comes to insurance gaps. Their agents truly understand Alabama’s unique quirks—from wild weather to regional property concerns.

This deep experience enables them to identify weak spots during those initial consultations. They know which risks matter most in each corner of the state.

Common risks they identify include:

- Tornado damage coverage gaps

- Flood zone misunderstandings

- Personal property undervaluation

- Liability coverage shortfalls

Clients avoid ugly surprises at claim time because of this. The team can usually predict which coverage areas will matter most for your home and location.

How The Agency Performs Coverage Audits And Finds Gaps

Woodall & Hoggle takes time to understand each client’s exposures by doing detailed coverage audits. They review existing policies line by line to identify missing or weak coverage.

The audit starts with a property assessment. Agents assess the home’s value, its contents, and any unique features that may require special protection.

They compare your current coverage limits with the actual cost of rebuilding. Many homeowners discover that their policy hasn’t kept pace with rising construction costs.

The audit examines:

- Dwelling coverage amounts

- Personal property limits

- Additional living expenses

- Liability protection levels

Agents explain the findings in simple, clear language. They’ll show you exactly where your coverage falls short and what risks that leaves you with.

Helping Clients Secure Flood And Windstorm Add-Ons Before Storm Season

Alabama’s weather can be brutal, and homeowners need the right coverage. Woodall & Hoggle utilizes local expertise to help clients prepare for the upcoming storm season in advance.

They know which neighborhoods require flood insurance, even if FEMA doesn’t classify them as a flood zone. Many Alabama homes face flood risks that standard insurance policies often overlook.

The agency helps clients add windstorm coverage for tornado and severe thunderstorm damage. They know which companies offer the best deals for Alabama’s weather drama.

Storm season prep includes:

- Reviewing windstorm deductibles

- Adding flood insurance

- Updating dwelling coverage for inflation

- Securing extra living expense protection

They emphasize the importance of timing, as some coverage can take a while to take effect. Getting everything set before storm season means you won’t get caught off guard.

Checklist — Questions To Ask Before Renewing Your Alabama Homeowner Policy

Alabama homeowners face risks such as hurricanes, tornadoes, and flooding that standard policies may not fully cover.

Reviewing your policy annually helps you identify gaps and ensure you’re protected against Alabama’s unique hazards.

Does My Policy Cover Flooding Or Windstorm Damage?

Most standard homeowner policies don’t cover flood damage at all. Alabama homeowners need separate flood insurance from the National Flood Insurance Program or private companies.

Wind damage coverage isn’t the same across all policies:

- Named storm deductibles kick in during hurricanes

- Tornado damage usually falls under standard wind provisions

- Hail damage is part of comprehensive coverage

Coastal Alabama residents deal with higher windstorm risks. Some policies use percentage deductibles for wind damage instead of flat dollar amounts.

Some insurers won’t cover wind damage in hurricane-prone areas. You might need separate windstorm coverage through the Alabama FAIR Plan.

Check your declarations page closely. Look for wind/hail deductibles and any storm exclusions that could leave you exposed.

What Exclusions Should I Be Aware Of?

Alabama policies often leave out earth movement—think sinkholes and landslides. The state’s limestone underground creates sinkholes in certain areas.

Common exclusions include:

- Flood damage from any source

- Earthquake damage

- Sewer backup without an endorsement

- Home business equipment

- Certain dog breeds

Mold exclusions are crucial in Alabama’s humid climate. Standard policies may limit or exclude mold coverage.

Power outage damage is usually not covered unless the problem originates on your property. Long outages from storms may not cover the cost of spoiled food or hotel stays.

Maintenance-related damage gets no coverage. If a leaky roof leads to storm damage, you could be out of luck on your claim.

How Much Coverage Do I Have For Personal Property?

Personal property coverage typically accounts for 50-70% of your dwelling coverage. So a $200,000 home might give you $100,000-$140,000 for your stuff.

Coverage types really matter:

| Coverage Type | What It Pays |

| Replacement Cost | Full cost to buy new items |

| Actual Cash Value | Current value minus depreciation |

Most policies set sub-limits for valuables. Jewelry might have a $1,000 cap, electronics a $2,500 cap, and so on.

Alabama homeowners should think about higher limits for:

- Hunting and fishing gear

- Outdoor furniture and grills

- Pool equipment

- Generator systems

Off-premises coverage protects your stuff away from home. Standard policies typically provide 10% of your personal property limit for items stolen from your car or hotel room.

What Endorsements Should I Add For Alabama Risks?

Sewer backup endorsement protects you from costly water damage caused by backed-up drains or sewers. Alabama gets heavy rains that can overwhelm local systems, so this one’s worth considering.

Equipment breakdown coverage covers your HVAC systems, water heaters, and appliances. High humidity and those annoying power fluctuations really put a strain on home systems here.

Service line coverage pays for repairs to utility lines running from the street to your house. Tree roots and shifting ground sometimes damage water, sewer, or gas lines—it’s more common than you’d think.

Identity theft protection helps you recover if someone steals your identity and covers some of the costs. It’s usually pretty affordable, but the peace of mind is a big plus.

Umbrella liability coverage gives you more protection beyond your standard policy limits. With Alabama’s litigation-friendly environment, increasing liability limits makes sense for most homeowners.

Generator coverage protects both portable and standby generators. Many Alabama homeowners install generators after experiencing prolonged storm outages.

Conclusion

Alabama homeowners face some unique insurance challenges. If you live here, you really have to pay attention.

Understanding coverage gaps can make a huge difference when something unexpected happens. Nobody wants a surprise bill after a storm.

Key steps every homeowner should take:

- Review policies every year for adequate coverage limits.

- Figure out what your current policy doesn’t cover.

- Think about extra coverage for floods, earthquakes, or whatever else seems likely in your area.

- Keep photos and receipts for your stuff—trust me, it helps.

Many people only realize they have common insurance gaps when they attempt to file a claim. That’s not the time you want to find out.

Critical areas to evaluate include:

| Coverage Type | Common Gap | Solution |

| Dwelling | Underinsurance | Get replacement cost estimates |

| Personal Property | Actual cash value limits | Add replacement cost coverage |

| Natural Disasters | Flood exclusions | Purchase separate flood insurance |

Alabama’s weather and geography bring their own risks. It just makes sense to line up coverage with what you’re actually facing.

If you check your policy regularly, you’ll catch changes in your home’s value or the value of your belongings. Construction costs don’t stay the same for long, either.

Homeowner insurance coverage gaps can become expensive quickly if a disaster strikes. It’s worth acting now instead of waiting.

Working with a good insurance pro can make all the difference. They’ll spot gaps you might miss.

Before renewing your policy, let Woodall & Hoggle identify coverage gaps and tailor protection for your Alabama home. Contact us to schedule.

Contact Us Today For An Appointment

Frequently Asked Questions

Does standard homeowner’s insurance in Alabama cover hurricane damage?

No, most standard policies exclude windstorm or hurricane damage — you’ll need a separate endorsement or policy.

Are floods included in homeowner’s insurance?

Flood damage is excluded. Alabama homeowners need a separate flood policy through NFIP or private insurers.

Why are so many claims denied in Alabama?

Claims are often denied because homeowners assume coverage for risks like mold, sewer backup, or storm surge that are not included in standard policies.

How much more does comprehensive coverage cost in Alabama?

On average, adding endorsements like wind and flood may increase premiums by 15–30%, but this is far less than paying out of pocket for uncovered damage.

How can I check if my policy has gaps?

Review your declarations page and exclusions section, then consult an agent who can compare options across multiple carriers.